Page 106 - Demo

P. 106

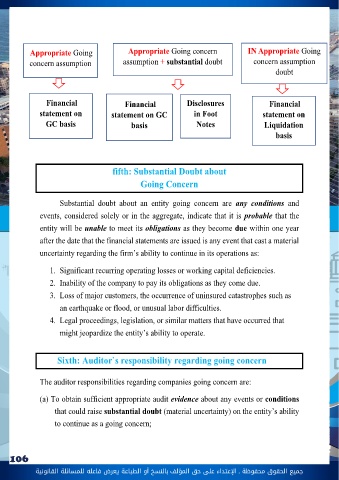

جميع الحقوق محفوظة ـ اإلعتداء عىل حق املؤلف 106 بالنسخ أو الطباعة يعرض فاعله للمسائلة القانونيةThird: How is going concern determinedFourth: Management responsibility relating to going concernSecond: definition of Going concern: Going concern\expected to operate for the foreseeable future or at least the next 12 months. It assumes that the business can generate income, meet its obligations due without the plan or the need to liquidate or restructuring its loan in the coming year. The going concern concept is a key assumption under generally accepted accounting principles (GAAP) & International financial reporting standards (IFRS). It can determine how financial statements are prepared, (on historical cost basis or liquidation basis). Which influence the stock price of a publicly traded company and affect whether a business can be approved for a loan. This term also refers to a company's ability to make enough money to stay afloat or to avoid bankruptcy. If a business is not a going concern, it means it's gone bankrupt and its assets were liquidated (in other terms it is doomed !!) It is the responsibility of the company Management to determine whether the business is able to continue in the foreseeable future for a period of at least 12 months. If it’s determined that the business is stable, financial statements are prepared using the going concern basis of accounting. This allows some prepaid expenses to be deferred until a later date & evaluating most assets and liabilities at their historical cost 1. IFRS requires management to make an assessment of an entity’s ability to continue as a going concern (to continue its operations for a reasonable period of at least 1 year from the date the financial statements are issued) and Appropriateness of going concern assumption. in their preparation of the financial statements this requires: