Page 80 - Demo

P. 80

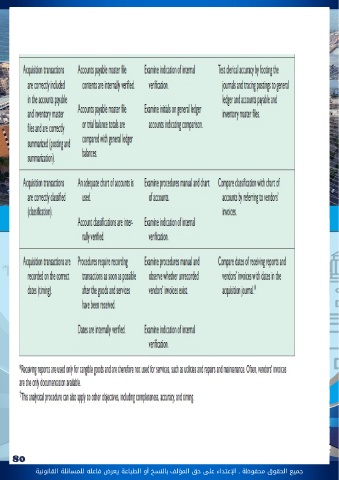

جميع الحقوق محفوظة ـ اإلعتداء عىل حق املؤلف 80 بالنسخ أو الطباعة يعرض فاعله للمسائلة القانونية2. Assess planned controls risk: uses the information obtained in understanding internal control to assess existing control determine any control deficiency and identify control risk. The auditor has to assess effectiveness of key controls: The key control activities Include1) Separation of asset Custody from Other Functions: Separation of responsibilities for signing checks and performing the accounts payable function 2) timely recording and independent review of transactions: Careful examination of supporting documents by the check signer at the time the check is signed. 3) authorization of payments: The signing of checks by an individual with proper authority 4) Documentation of payments: The checks should be prenumbered to make it easier to account for the auditor associates the controls with the 6 objectives of auditing sales transactions using Control Matrix. The auditor Assesses control risk for each objective by evaluating the controls and deficiencies for each objective. Identify the 6 objectives of auditing sales transactions (Occurrence, Completeness, Posting and summarizing, classification and timing) Four of the six transaction-related audit objectives for acquisitions deserve special attention1) Occurrence: are recorded Acquisitions Are for Goods and Services actually Received,2) Completeness: are all existing Acquisitions Recorded3) Accuracy: are Acquisitions Are Accurately Recorded4) Classification: Acquisitions Are Correctly Classified5) Posting and Summarization: are all purchases on account transactions recorded A/P master file6) Timing: all transactions recorded in the correct dates